In this task, you explore business rules of the miniloan rule project in Decision Center.

You use the Explore tab to navigate through your folders and select what you want to work on. The default smart folders display most of the project elements.

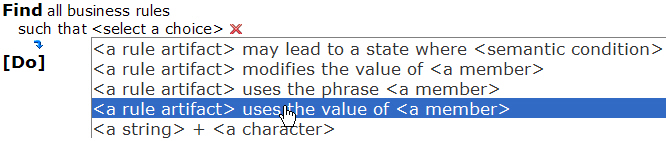

In this task, you discover the business rules that make up the business policy, for example an action rule and a decision table, and you generate a report on all the rule artifacts in the rule project. Then, you write a query that returns the rules that match your search criteria.

![]() This task should take you about 10 minutes to complete.

This task should take you about 10 minutes to complete.